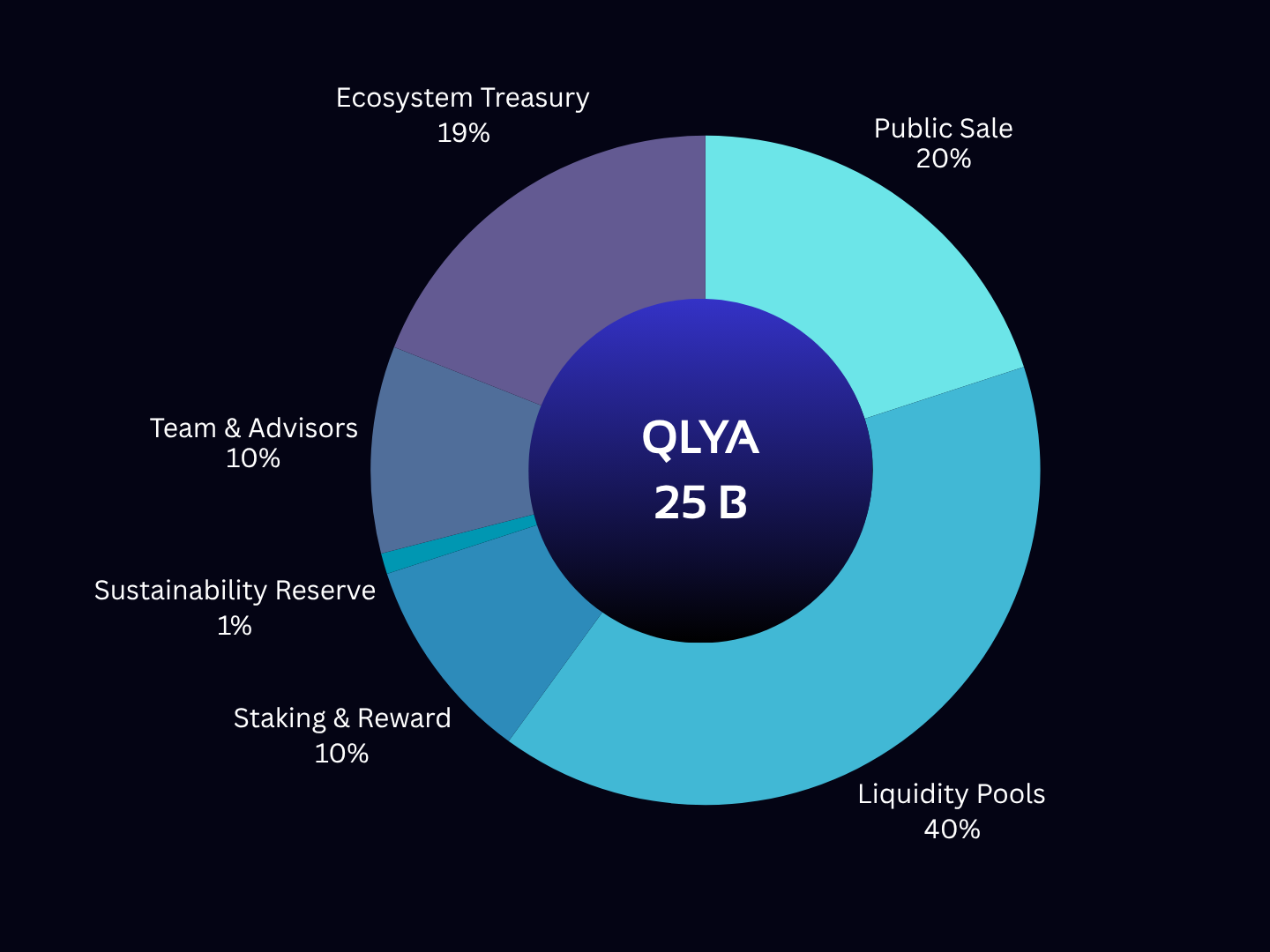

Public Sale – 20%

Distributed to early supporters to form initial liquidity and ensure decentralization.

Liquidity Pools – 40%

Reserved for pool establishment and stable price discovery across Stellar-based pairs (QLYA/XLM, QLYA/USDC, etc.).

Staking & Rewards – 10%

Incentives for long-term holders and early contributors. A portion will be time-locked (6 months), and part allocated to promotional airdrops.

Team & Advisors – 10%

Allocated for project operations, R&D, and strategic growth. Locked and vested to align with long-term sustainability.

Ecosystem Treasury & Development – 19%

Used for future partnerships, liquidity injections, and development — gradually released to support expansion.

Sustainability Reserve – 1% (+ 2% of ongoing protocol revenue)

Hybrid insurance fund—1 % QLYA supply locked by DAO + 2 % of all future XLM/USDC revenue to ensure long-term stability.

Sustainability Reserve

To ensure long-term protocol health, Quelya allocates ~2% of total supply plus a portion of on-chain revenues to a continuously monitored reserve.

This fund acts as an insurance layer — stabilizing liquidity, protecting against volatility, and funding recovery measures in unforeseen conditions.

The Sustainability Reserve acts as Quelya’s stability pillar, ensuring long-term protection and liquidity continuity.

Token Component (1%)

- Locked within a DAO-controlled Stellar wallet

- Deployable only via community governance vote

- Functions as an emergency fund or liquidity support buffer

Revenue Component (2%)

- Auto-allocated from protocol revenues:

- LP fees

- Yield distributions

- Buyback proceeds

- Held in XLM/USDC to stabilize liquidity

- Reinforces resilience during high volatility

Together, these components form a hybrid safety net—combining protocol-level foresight with decentralized governance.

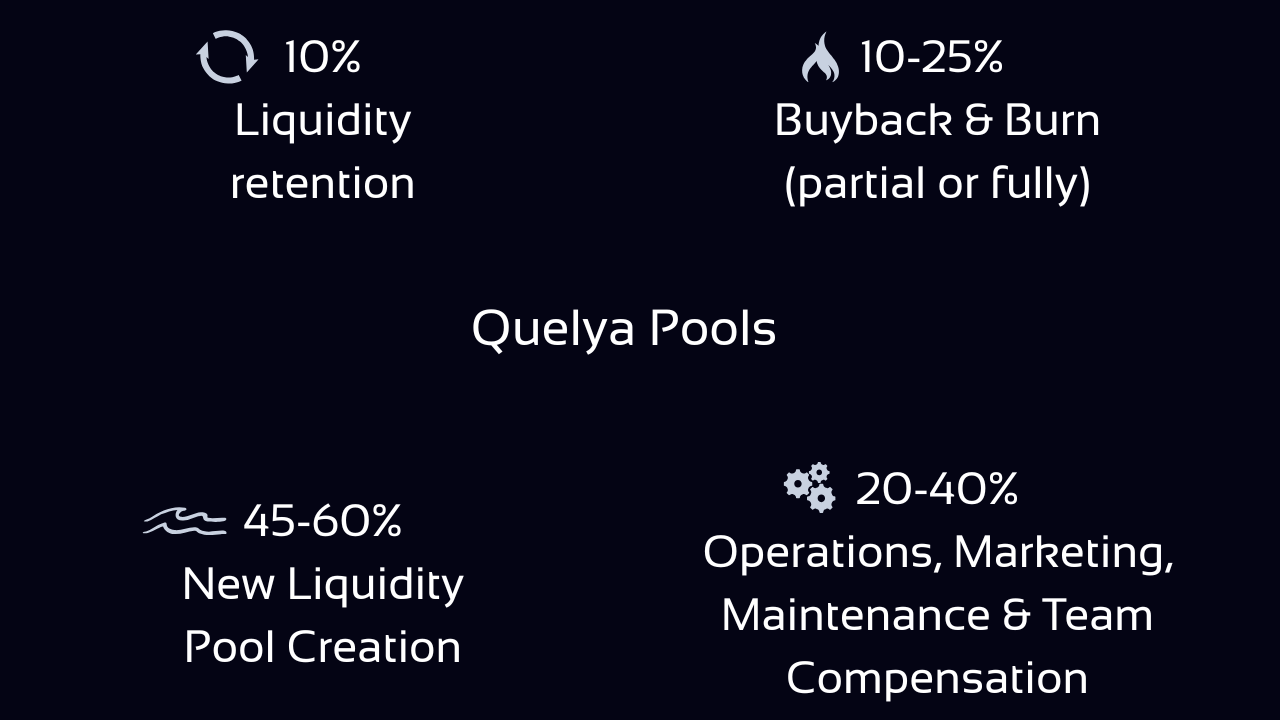

Liquidity Retention – 10%

| Maintained within each pool to preserve a stable liquidity base. |

Buyback & Burn – 10-25 %

Used for continuous buyback and partial/full burn of QLYA, steadily reducing total supply. Dynamic: starts lower, grows later

New Liquidity Pool Creation – 45-60%

Reinvested into the LP Factory to expand liquidity coverage across new asset pairs.

Operations, Marketing, Maintenence – 10-25%

Allocated for project operations, R&D, and strategic growth. Covers infrastructure maintenance, operational costs, and promotional campaigns.

Team Compensation – 10-15%

Covers the core team responsible for developing, maintaining, and expanding the Quelya ecosystem. This includes founders, developers, security engineers, support staff, and future hires.

Presale Revenue Allocation

Infrastructure & Maintenance – 35%

| Node operation, server costs, and backend maintenance. |

Development & Listings – 25%

| Smart contract expansion, DEX/CEX listings, and team resources. |

Marketing & Promotion – 40%

Awareness campaigns, partnerships, and global outreach.

Any remaining funds post-presale will reinforce the post-ICO liquidity pool.

ICO Revenue Allocation (Indicative)

Liquidity Pool Establishment – 40%

| Core liquidity provisioning across major Stellar pairs. Such may include but not limited to: XLM/QLYA, USDC/QLYA, VELO/QLYA, SHX/QLYA. |

Development & Team – 30%

Development, Salaries, and Engineering

Marketing & Community – 10%

Used for scaling operations and promoting ecosystem growth.

Buyback & Burn – 7.5 %

Continuous supply reduction in controlled cycles to maintain price stability.

Operation & Legal – 7.5 %

Used for legal costs, company costs and any other operational needs.

ICO allocations may adjust slightly depending on market conditions and operational needs. All updates will be communicated transparently to the community.

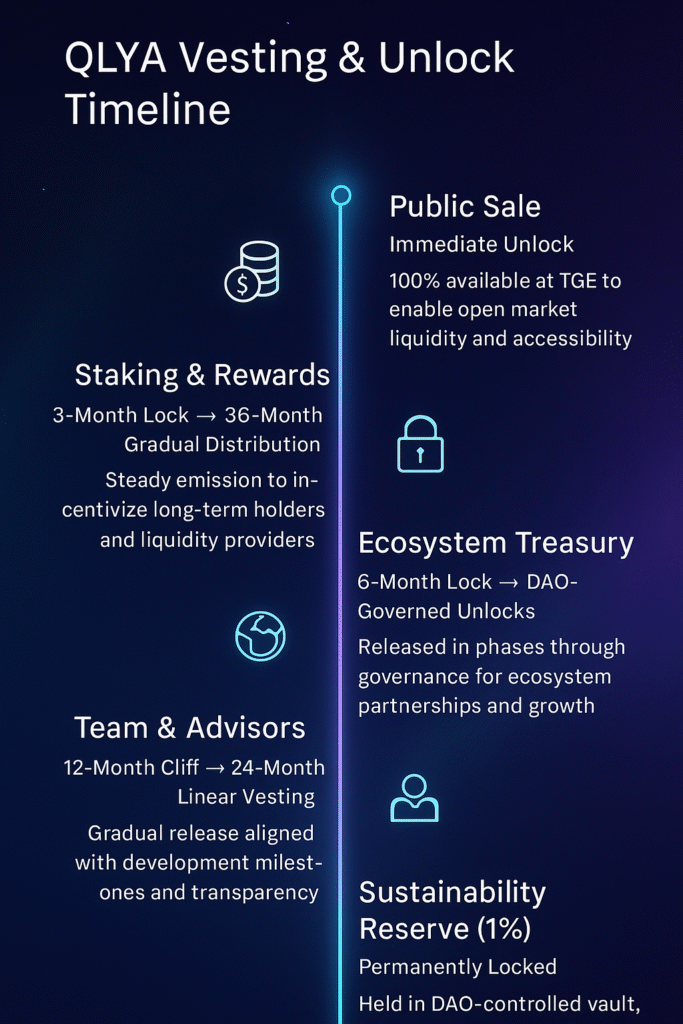

Team & Advisors – 12 Months Locked – 24 Month Linear Vesting

| Gradual release to maintain stability and ensure alignment with project milestones. |

Staking & Rewards – 3 Months Locked – Distributed over 36 months

Continuous emission model rewarding long-term participants and liquidity providers.

Ecosystem Treasury – 6 Months Locked – DAO-governed gradual unlock

Funds deployed based on governance proposals for ecosystem expansion and partnerships.

Public Sale – None – Immediate Liquidity

Fully unlocked at distribution to ensure market entry and accessibility.

Sustainability Reserve – Permanent – Locked in DAO vault

Only deployable by governance vote for emergency or stabilization measures.

Vesting Disclaimer

The vesting schedule presented herein is indicative and subject to modification based on project development, market conditions, or strategic adjustments approved by the Quelya DAO.

All token releases will follow transparent on-chain governance and publicly verifiable transactions.

No guarantees are made regarding exact release timelines, as vesting parameters may evolve to ensure long-term protocol sustainability, fair distribution, and ecosystem stability.

QLYA Token Utility Overview

Quelya (QLYA) is the multi-purpose token powering every layer of the Quelya Protocol — from liquidity generation to governance.

It is designed for utility, sustainability, and growth, ensuring both ecosystem stability and holder engagement.

Liquidity Powering

QLYA fuels all pool and vault activities, enabling seamless swaps, automated buybacks, and reinvestment loops within the Stellar ecosystem.

Staking & Yield

Holders can stake QLYA to earn rewards from protocol fees and liquidity performance. Long-term participants benefit from higher multipliers and governance influence.

Governance

Each token represents voting power within the DAO, allowing holders to participate in key proposals, upgrades, and allocation decisions.

Buyback & Burn Cycles

A portion of revenue automatically buys back and burns QLYA, creating a deflationary mechanism tied to ecosystem activity.

Access to Exclusive Features

Future utility will include access to Quelya Vaults, premium yield products, and early participation in new liquidity pair launches (via the Nexus).

Cross-Chain Liquidity Network (Future Utility)

QLYA will power a cross-chain liquidity layer, connecting Stellar-based pools with ecosystems such as Ethereum, Polygon, and Solana — enabling seamless DeFi interoperability.

Key Features

- Gasless Bridge Fees: QLYA acts as the native medium of exchange for bridging assets, reducing friction in cross-chain transfers.

- Unified Liquidity Routing: Pools on different networks share liquidity through QLYA-pegged anchors, optimizing price stability and depth.

- Cross-Protocol Yield Sharing: A percentage of yield generated on other chains (in stablecoins or wrapped assets) is routed back into Stellar pools, rewarding QLYA holders.

Impact

This will turn QLYA into a liquidity nexus token — not just powering Quelya’s own ecosystem, but interlinking Stellar’s DeFi landscape with other major blockchains, while maintaining efficiency and low-cost transfers.

Cross-Protocol Access (Quelya Nexus)

QLYA functions as a cross-protocol key to interact with all Quelya dApps and external Stellar-based DeFi partners.

Key Features

- Unlock premium tools and partner integrations

- Participate in cross-protocol staking pools

- Earn partner rewards through unified QLYA staking

Quelya Exchange Utility

QLYA acts as the base settlement and incentive token for the upcoming Quelya Exchange, powering liquidity and providing trade benefits.

Key Features

- Reduced trading fees when using QLYA

- Earn QLYA-based cashback on trades and liquidity provision

- Access to exclusive trading pairs and early listings

Quelya Wallet Integration

Use QLYA within the Quelya Wallet for gasless transactions, staking access, and instant swaps within the Stellar network.

Key Features

- Fee discounts when paying network or transaction fees in QLYA

- Priority transaction routing for QLYA-based pairs

- Exclusive access to wallet-based reward programs and airdrops

Token Flow Summary

Every QLYA in circulation plays a role — powering liquidity, funding growth, and reinforcing sustainability through continuous cycles of reinvestment and governance.

Deflationary Cycle Explained

Quelya’s deflationary tokenomics are governed by three key mechanisms:

- Buyback: A percentage of protocol revenue is used to repurchase QLYA from the market.

- Burn: A portion of the repurchased tokens are permanently burned, reducing circulating supply.

- Reinvest: Remaining funds fuel new LP creation and protocol expansion.

This cyclical model ensures ongoing scarcity, liquidity stability, and community-driven growth.

Transparency & Governance

- All QLYA token operations are tracked on-chain via Stellar smart contracts.

- Governance decisions (e.g., reserve deployment, burn cycles) occur through DAO voting.

- Updates, audits, and analytics will be published regularly via Quelya Nexus Dashboard.

Full transparency and sustainability—anchored by Stellar, guided by the Quelya DAO.