QUELYA PROTOCOL — 2025–2027 ROADMAP

Quelya — Development Roadmap

The development of Quelya Protocol is structured into distinct, goal-oriented phases designed to ensure methodical execution, transparent progress, and sustainable ecosystem growth. Each phase builds upon the previous one, forming a clear trajectory from token creation to full decentralization and ecosystem expansion.

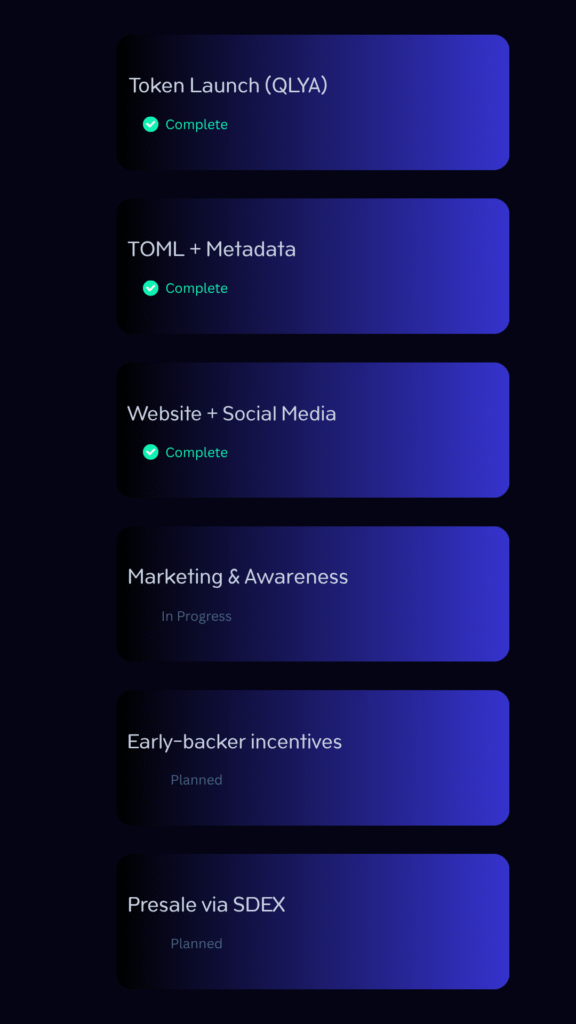

Current Progress

Foundation & Token Launch

October – November 2025

- Token creation on Stellar (completed ✅)

- TOML + metadata verification (completed ✅)

- Launch of official channels: Website, X, Telegram (completed✅)

- Initial marketing rollout and brand identity setup (in progress)

- Smart buyback/burn logic planning (in progress)

Presale & Initial Community Growth

December 2025 – January 2026

- Public presale via Stellar DEX (LOBSTR, Scopuly)

- Early-backer incentives and community-building campaign

- Launch of educational content series (DeFi learning, Stellar insights)

- Telegram ambassador & referral program rollout

- Begin partnerships with Stellar-based communities

Public ICO & Liquidity Activation

February – March 2026

- Official ICO launch

- Allocation of raised funds into initial liquidity pools

- Automated buyback & burn cycle v1

- CoinMarketCap & CoinGecko listing submission

- Expanded exchange visibility on Stellar ecosystem platforms

Vaults & Yield Layer Deployment

April – May 2026

- Development and beta of Quelya Vaults (staking/yield contracts)

- LP reward auto-reinvestment feature

- Treasury activation for ecosystem expansion

- Buyback & burn wave #2 (20–30% of protocol yield)

- UI/UX enhancements for community dashboard

Governance & DAO Layer — Quelya Orbit

June – July 2026

- Governance framework launch (proposal + voting system)

- DAO smart contract deployment

- Community governance onboarding and first proposals

- Integration of transparency dashboard

Ecosystem Integration — Quelya Nexus

August – December 2026

- Partnership onboarding (wallets, protocols, RWAs)

- API layer for DeFi developers

- Anchor integration for fiat on/off-ramps

- Cross-chain liquidity bridge exploration

- Expanded burn strategy for deflationary mechanics

Long-Term Growth & Expansion

Post Year 2026

- Launch of Quelya Wallet and Quelya Exchange (Phase 2 products)

- Global community expansion initiatives

- LayerZero & cross-chain bridge deployment

- Real-world integrations with RWA protocols on Stellar

Disclaimer:

The roadmap and all time estimates presented are for informational purposes only. Actual timelines may vary based on development progress, market conditions, and other unforeseen factors. Quelya Protocol reserves the right to adjust milestones and schedules to ensure the long-term success and stability of the project.

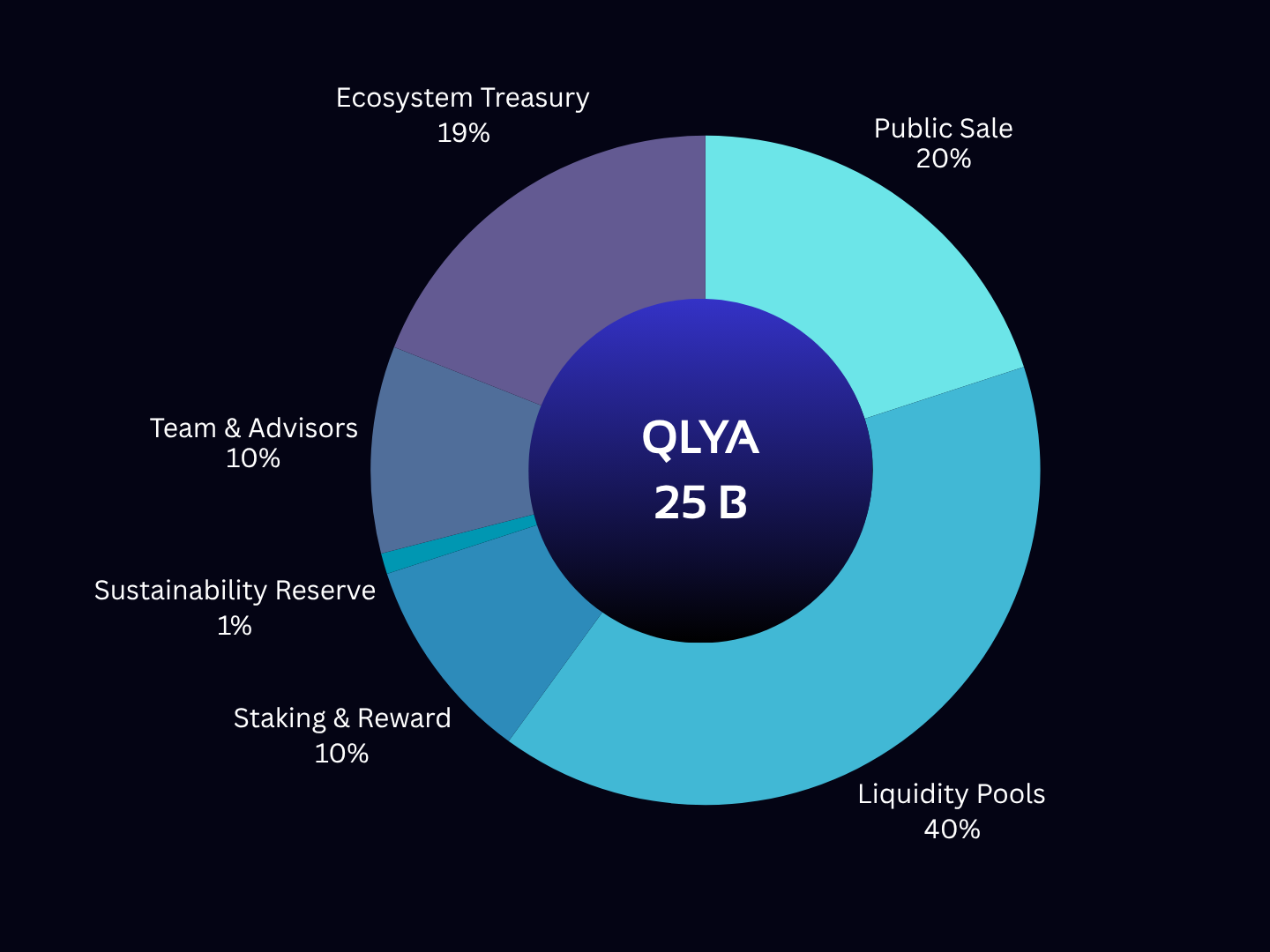

Public Sale – 20%

Distributed to early supporters to form initial liquidity and ensure decentralization.

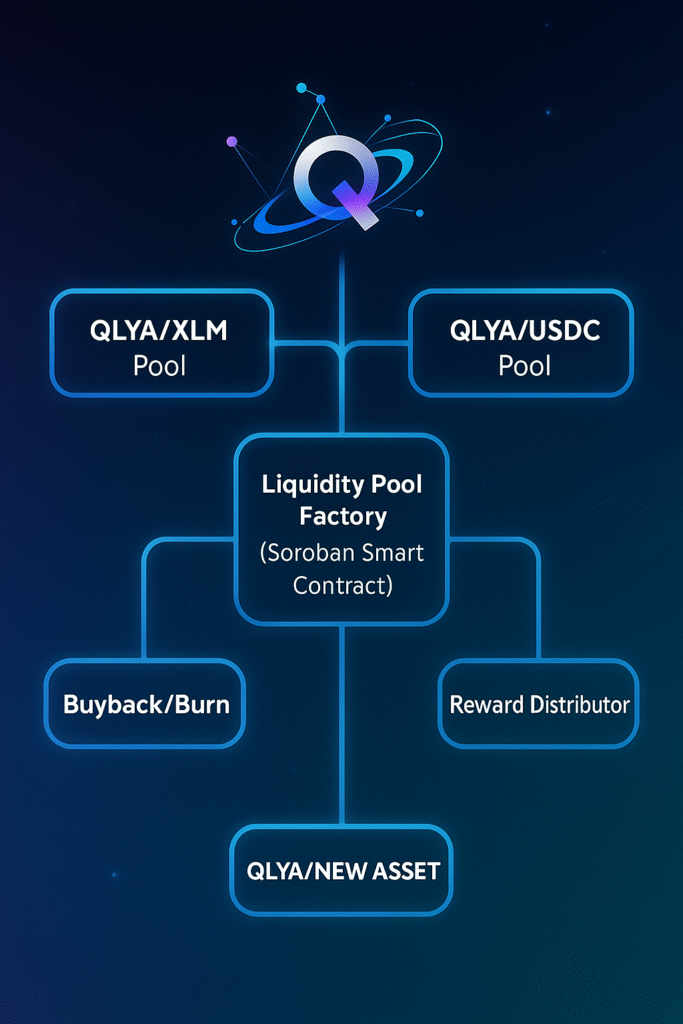

Liquidity Pools – 40%

Reserved for pool establishment and stable price discovery across Stellar-based pairs (QLYA/XLM, QLYA/USDC, etc.).

Staking & Rewards – 10%

Incentives for long-term holders and early contributors. A portion will be time-locked (6 months), and part allocated to promotional airdrops.

Team & Advisors – 10%

Allocated for project operations, R&D, and strategic growth. Locked and vested to align with long-term sustainability.

Ecosystem Treasury & Development – 19%

Used for future partnerships, liquidity injections, and development — gradually released to support expansion.

Sustainability Reserve – 1% (+ 2% of ongoing protocol revenue)

Hybrid insurance fund—1 % QLYA supply locked by DAO + 2 % of all future XLM/USDC revenue to ensure long-term stability.

Sustainability Reserve

To ensure long-term protocol health, Quelya allocates ~2% of total supply plus a portion of on-chain revenues to a continuously monitored reserve.

This fund acts as an insurance layer — stabilizing liquidity, protecting against volatility, and funding recovery measures in unforeseen conditions.

Quelya Ecosystem

Quelya Pools

The foundation of Quelya’s liquidity ecosystem, enabling seamless asset pairing, reward generation, and sustainable token circulation through smart, self-balancing pools.

Quelya Vault

A secure, yield-optimized storage protocol designed to maximize returns through staking, compounding rewards, and strategic liquidity management.

Quelya Orbit

The analytics and insight hub of the Quelya ecosystem, visualizing performance, liquidity flow, and governance metrics in real time.

Quelya Nexus

The connective layer of Quelya — linking pools, vaults, and partners through interoperable smart contracts to ensure seamless DeFi integration.

Quelya Walet

A secure, intuitive wallet for managing, staking, and interacting with the Quelya ecosystem — built for accessibility and control.

Quelya Exchange

A decentralized trading hub powered by Stellar Soroban smart contracts — ensuring transparent, efficient, and low-fee asset swaps.

What is Quelya Protocol?

Quelya is a Stellar-based DeFi ecosystem focused on liquidity optimization, sustainable token growth, and community-driven governance through transparent mechanisms like buyback-and-burn and reinvestment cycles.

How can I buy QLYA tokens?

QLYA can be purchased directly on Stellar decentralized exchanges such as Scopuly, Lobstr or StellarTerm. Simply connect a Stellar wallet (like Lobstr) and search for “QLYA”. Always verify the issuing address before trading.

When will staking and yield farming be available?

Staking and yield farming features will be introduced once the initial and secondary ICO phases are completed. This ensures sufficient liquidity and reserves for stable yield generation.

What is the Quelya Ecosystem made of?

The ecosystem consists of interconnected modules:

- Quelya Pools – liquidity layer

- Quelya Vaults – staking & yield

- Quelya Orbit – governance system

- Quelya Nexus – partner and integration hub

- Quelya Wallet – comming soon

- Quelya Exchange – comming soon

Each component supports the others, creating a balanced and sustainable DeFi framework.

What makes Quelya different from other DeFi projects?

Unlike many short-term reward models, Quelya prioritizes sustainability through controlled liquidity cycles, strategic buybacks, and a transparent on-chain governance structure — all built on Stellar’s efficient, low-cost infrastructure.

How does Quelya support real-world use cases?

By integrating Stellar’s fast and low-cost network with its modular DeFi architecture, Quelya enables cross-border liquidity, tokenized asset pools, and seamless yield opportunities that bridge traditional finance and DeFi.

What gives QLYA its long-term value?

QLYA’s value is driven by its ecosystem utility — powering liquidity pools, staking, governance, and the buyback-and-burn system that continually supports supply reduction and ecosystem stability.

Is the project audited and transparent?

Yes. Smart contract audits and transparent reporting are core priorities. Quelya will publish public audits and on-chain analytics through trusted explorers like Stellar.Expert and verified partners.

How can I participate in the Quelya ecosystem?

You can acquire QLYA through supported Stellar DEX platforms, stake or provide liquidity in Quelya Pools, and later use integrated services like Quelya Vault, Wallet, and Exchange once released.