Key Features

Dynamic Liquidity Management

Quelya Pools automatically adjust reserves across core pairs (e.g., QLYA/XLM, QLYA/USDC) to stabilize price discovery and support healthy trading volume.

Integrated Buyback & Burn Cycle

A fixed portion of pool revenue is allocated to periodic QLYA buybacks and burns, gradually reducing supply and supporting long-term token value.

Deflationary Yield Distribution

Staking rewards and LP incentives are derived from protocol-generated fees — ensuring sustainable yield rather than inflationary emissions.

LP Factory Integration

Through the LP Factory mechanism, new asset pairs can be created, supported, and incentivized, allowing the ecosystem to scale organically across the Stellar network.

Sustainability & Governance Connection

Quelya Pools are governed under the Quelya Orbit DAO, allowing community participants to propose and vote on liquidity parameters, pool expansions, and allocation adjustments.

This ensures transparent, community-driven management of liquidity while maintaining the deflationary, yield-driven structure that underpins the protocol.

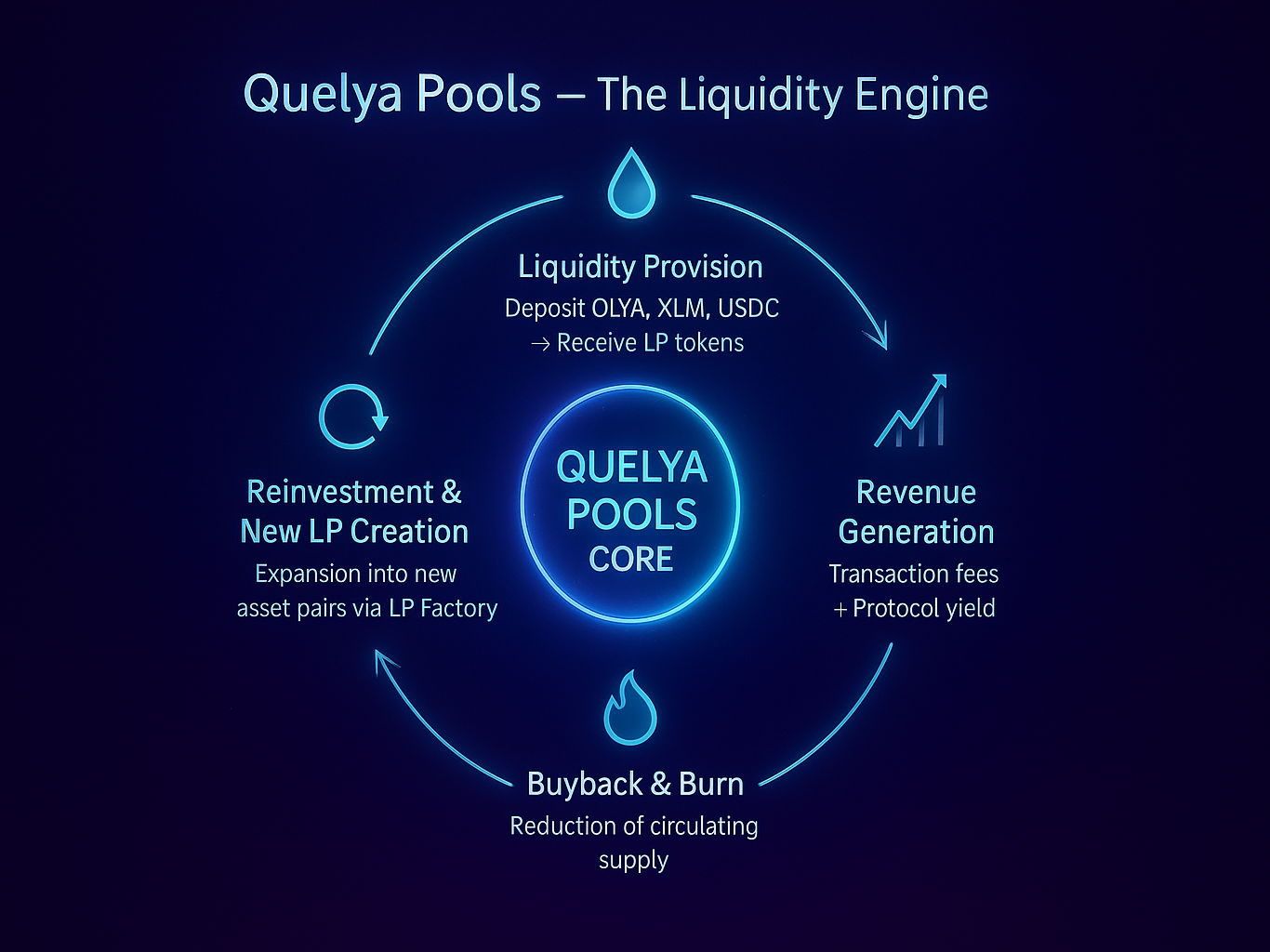

Core Token Flow

Liquidity Provision: Users deposit QLYA, XLM, or USDC into pools and receive LP tokens in return.

Revenue Generation: Pool transactions generate fees distributed across participants and protocol mechanisms.

Buyback & Burn: A dynamic percentage of revenue is used to repurchase and burn QLYA, reducing circulating supply.

Reinvestment Cycle: Remaining proceeds are recycled into new LP creation and liquidity reinforcement.

Future Outlook

As the Quelya ecosystem expands, Pools will evolve into multi-asset liquidity hubs, potentially bridging cross-chain assets through Quelya Nexus.

These developments will enable a truly interoperable liquidity network — the foundation for Quelya’s long-term mission of sustainable, scalable DeFi on Stellar.

Vault Mechanics

Dynamic Allocation Protocol (DAP)

A built-in algorithm monitors pool performance, reallocating liquidity dynamically for optimal efficiency.

Multi-Asset Support

Operates with QLYA, XLM, and stable assets (USDC, EURC) to sustain healthy liquidity and stable yield flows.

Secured Architecture

All Vault contracts undergo audits and are governed via DAO parameters to ensure full transparency and safety.

Cross-chain Lock

Locks the tokens to establish a bridge to other blockchains post multi-chain expansion.

Sustainability Integration

A portion of Vault-generated yield (approx. 2%) contributes to the Sustainability Reserve, ensuring long-term operational resilience.

Supports buyback & burn mechanisms during high-liquidity phases to maintain QLYA’s deflationary model.

Core Functions

Automated Yield Optimization:

Continuously reallocates assets across Quelya Pools and partner protocols to maximize APY and reduce idle liquidity.

Collateralization & Treasury Management:

Stores ecosystem reserves and collateral, providing a foundation for lending, staking, and cross-protocol interactions.

Reward Distribution Hub:

Facilitates staking payouts, reward harvesting, and redistribution in a transparent, on-chain process.

Future Expansion

Integration with cross-chain DeFi protocols to expand yield strategies beyond Stellar.

Introduction of user-governed Vault tiers, allowing investors to choose between conservative or high-yield risk profiles.

Integration Across the Quelya Ecosystem

Quelya Pools

Function:

Governance over LP creation, pool weighting, and yield parameters

Benefit:

Dynamic liquidity management

Quelya Vaults

Function:

DAO votes on staking incentives, reward emissions, and unlock schedules

Benefit:

Transparent reward governance

Quelya Nexus

Function:

Governance access for cross-chain bridge parameters and security updates

Benefit:

Cross-chain adaptability

Sustainability Reserve

Function:

Controlled by DAO multi-sig via Orbit

Benefit:

Long-term protocol stability

Core Governance Architecture

1. Token-Based Voting Power

- Governance participation is powered by QLYA tokens, which can be staked or delegated to voting contracts.

- The more QLYA staked, the higher the voting weight — ensuring that governance influence is tied to commitment and skin-in-the-game.

- Voting rights can be delegated to trusted representatives, encouraging broader participation even from passive holders.

2. Proposal Lifecycle

- Submission: Any eligible QLYA holder can submit a governance proposal (e.g., protocol upgrades, fund deployment, new asset listings).

- Review Phase: Proposals enter a review stage, where the community can discuss, refine, or suggest modifications.

- Voting Phase: After the review period, proposals are opened for voting through the Quelya Orbit dashboard.

- Execution: Approved proposals are executed automatically via Soroban smart contracts, ensuring zero human interference and full transparency.

3. Treasury & Reserve Oversight

- Treasury transactions are on-chain and verifiable, allowing for full public auditability.

- The Orbit Treasury manages the Sustainability Reserve, Ecosystem Development Fund, and Buyback & Burn allocations.

- All treasury actions — including transfers, burns, or reinvestments — are governed by community-approved proposals.

Future of Quelya Orbit

As Quelya expands into a cross-chain liquidity network, Orbit will evolve into a meta-governance layer, capable of coordinating multi-chain proposals and treasury management across integrated ecosystems. This will ensure that Quelya’s decentralized values extend far beyond the Stellar network — creating a truly autonomous and interoperable DeFi governance model.

Core Architecture

Liquidity Routing & Balancing

Quelya Nexus continuously monitors liquidity distribution across Pools, Vaults, and Exchange pairs.

It automatically reallocates assets when imbalances occur, ensuring healthy pool ratios and reducing slippage during swaps.

By dynamically adjusting liquidity weights, the system preserves optimal yield performance and long-term sustainability.

Key Benefits:

- Stabilizes token prices and improves pair depth

- Prevents over-concentration in single pools

- Enables efficient cross-pair arbitrage protection

Inter-Protocol Communication Layer

Acting as the data and governance bridge, the Nexus facilitates two-way communication between smart contracts and governance modules managed through Quelya Orbit.

This includes synchronizing DAO votes, distributing yield results, executing on-chain proposals, and managing treasury actions through automated triggers.

Key Features:

- Real-time data feeds for governance tracking

- Secure contract-to-contract calls between components

- Built-in validation for DAO-approved actions

Cross-Chain Interoperability Layer

Quelya Nexus is designed to evolve into a cross-chain liquidity network — enabling Stellar-based assets to flow seamlessly across other supported chains via wrapped assets and interoperability bridges.

This framework lays the foundation for the future expansion of Quelya into multi-chain DeFi, connecting liquidity and governance across ecosystems.

Planned Integrations:

Unified liquidity dashboard across supported networks

Wrapped QLYA tokens for multi-chain circulation

Smart Yield Optimization Engine

An intelligent optimization protocol analyzes pool metrics, transaction volume, and yield performance.

It reallocates resources between Pools, Vaults, and partner DEXs to maximize reward efficiency and minimize risk exposure.

Mechanisms:

- Continuous buyback and reinvestment cycles

- Algorithmic rebalancing based on market indicators

- Risk-weighted yield scoring

Developer & Integration Framework

The Nexus provides an API-driven architecture for developers, DApps, and external liquidity providers.

This allows partners to integrate directly into Quelya’s liquidity engine, enabling third-party tools, analytics dashboards, or DeFi automation bots to leverage Nexus data.

Integration Points:

SDK support for future cross-chain deployments

REST & GraphQL APIs for real-time liquidity data

WebSocket streams for price and governance updates

Strategic Role in the Ecosystem

Quelya Nexus acts as the spinal cord of the entire ecosystem — not just connecting but actively coordinating all operational and economic layers.

It allows Quelya to function as a unified liquidity network, where capital efficiency, governance, and interoperability work in perfect harmony.

In Summary:

- Powers cross-protocol and cross-chain liquidity flow

- Strengthens the Quelya token utility and yield mechanisms

- Lays the foundation for long-term scalability and external integrations

Security & Governance

- Built on Stellar’s Soroban smart contract standard

- Audited interaction modules for liquidity and governance safety

- DAO-controlled upgradeability to ensure decentralized decision-making

Core Features

Unified Asset & Portfolio Management

- Manage QLYA, XLM, USDC, and other Stellar-based tokens in a clean, intuitive dashboard.

- Monitor real-time asset performance, staking yields, and transaction history.

- Built-in analytics track protocol participation metrics, such as rewards earned, votes cast, or LP positions held.

- Optional “Expert Mode” for users to customize their data dashboard with advanced metrics and fee efficiency stats.

Advanced Security & Custody

- Non-custodial by design — users maintain full control of private keys.

- Implements multi-signature authorization, hardware wallet compatibility (Ledger, Trezor), and session-based encryption.

- Utilizes Stellar’s account signer system for layered access rights (ideal for DAO wallets or team-managed accounts).

- Backup & recovery through encrypted key shards, stored across distributed vault nodes (optional, future feature).

Ecosystem Connectivity

- Seamlessly connects with Quelya Pools (for LP staking and rewards) and Quelya Vault (for auto-compounding or savings).

- Provides direct access to Quelya Exchange for swaps and liquidity management.

- Native integration with Quelya Orbit enables governance voting directly inside the wallet.

- Smart routing links via Quelya Nexus provide interoperability to partner blockchains.

Smart Transaction Layer

- Employs fee optimization algorithms to minimize Stellar network costs.

- Batch transactions enable one-click staking, claiming, or reinvesting.

- Future-ready for cross-chain transaction bundling using Nexus bridges.

DAO Integration & Governance Access

- Direct governance portal powered by Quelya Orbit.

- Submit proposals, vote on upgrades, and view live DAO analytics without leaving the wallet.

- Delegation features for passive participation or community representation.

Cross-Platform & Extension Support

- Available as web app, mobile app (iOS & Android), and browser extension.

- Optional API integration for third-party DeFi platforms and Quelya ecosystem partners.

- Unified user authentication across devices using Stellar Federation Service.

Technical Architecture

Framework:

Built on Stellar SDK with modular smart-contract adapters for Quelya-specific operations.

Standards:’

Compatible with SEP-0008 (payments), SEP-0024 (interactive deposits/withdrawals), SEP-0030 (key management).

Security Layer:

End-to-end encryption, optional 2FA, and role-based access control for institutional wallets.

Scalability:

Optimized for low latency and future cross-chain extension via Quelya Nexus.

Integration:

Native link to Orbit (Governance), Pools (Liquidity), Vault (Yield), Exchange (Trading).

Core Features

Smart Liquidity Routing

At the core of the Exchange lies an intelligent routing engine that automatically finds the most efficient trade paths between asset pairs.

When users execute a swap — for example, QLYA → XLM → USDC — the system dynamically reallocates liquidity to ensure:

- Lowest possible slippage

- Minimized transaction fees

- Instant settlement, leveraging Stellar’s native speed

This feature is powered by Quelya’s adaptive pool architecture, allowing users to trade through multiple pools without leaving the ecosystem.

Unified Trading Layer

Quelya Exchange is more than a swap terminal — it’s a comprehensive DeFi dashboard:

- Track live pool metrics, trading volumes, and yields

- Execute swaps, stake LP tokens, and claim rewards

- View your entire portfolio (via Quelya Wallet) in one interface

Every trade feeds directly into the Quelya economic loop — generating yield for Vaults, replenishing liquidity in Pools, and supporting token buybacks.

Cross-Chain Compatibility (Future Phase)

While Quelya’s foundation lies on the Stellar network, its long-term vision reaches beyond — building a cross-chain liquidity framework through Quelya Nexus.

This integration will enable:

- Swaps and staking across multiple blockchain ecosystems (e.g., Ethereum, Solana, Polygon)

- Token bridging using wrapped QLYA assets

- Interconnected liquidity pools spanning multiple networks

The goal: make Quelya Exchange a multi-chain liquidity hub seamlessly connecting assets across DeFi and TradFi.

Governance & Community Listing Power

Through Quelya Orbit (DAO), community members holding QLYA tokens can vote on new asset listings, trading incentives, and protocol upgrades.

This governance layer ensures transparency and alignment — keeping liquidity growth in the hands of the community.

Every listing proposal, reward adjustment, and buyback schedule is subject to public governance, creating an open and accountable ecosystem.

Core Benefits

Community-first governance: True DAO-driven evolution.

Transparent & auditable: Every transaction visible on-chain via Stellar.

Ultra-low fees: Leveraging Stellar’s efficiency for sustainable trading.

Self-reinforcing economics: Every trade strengthens liquidity and rewards holders.

Ecosystem Integration

- Quelya Wallet: Enables direct, one-click swaps and staking.

- Quelya Vault: Uses Exchange data to optimize yield strategies.

- Quelya Pools: Provide the foundational liquidity layer for all trading pairs.

- Quelya Orbit: Handles governance, voting, and decision-making for new listings.

- Quelya Nexus: Expands trading across multiple blockchains via bridges.

A Unified Flow of Liquidity, Governance, and Utility.

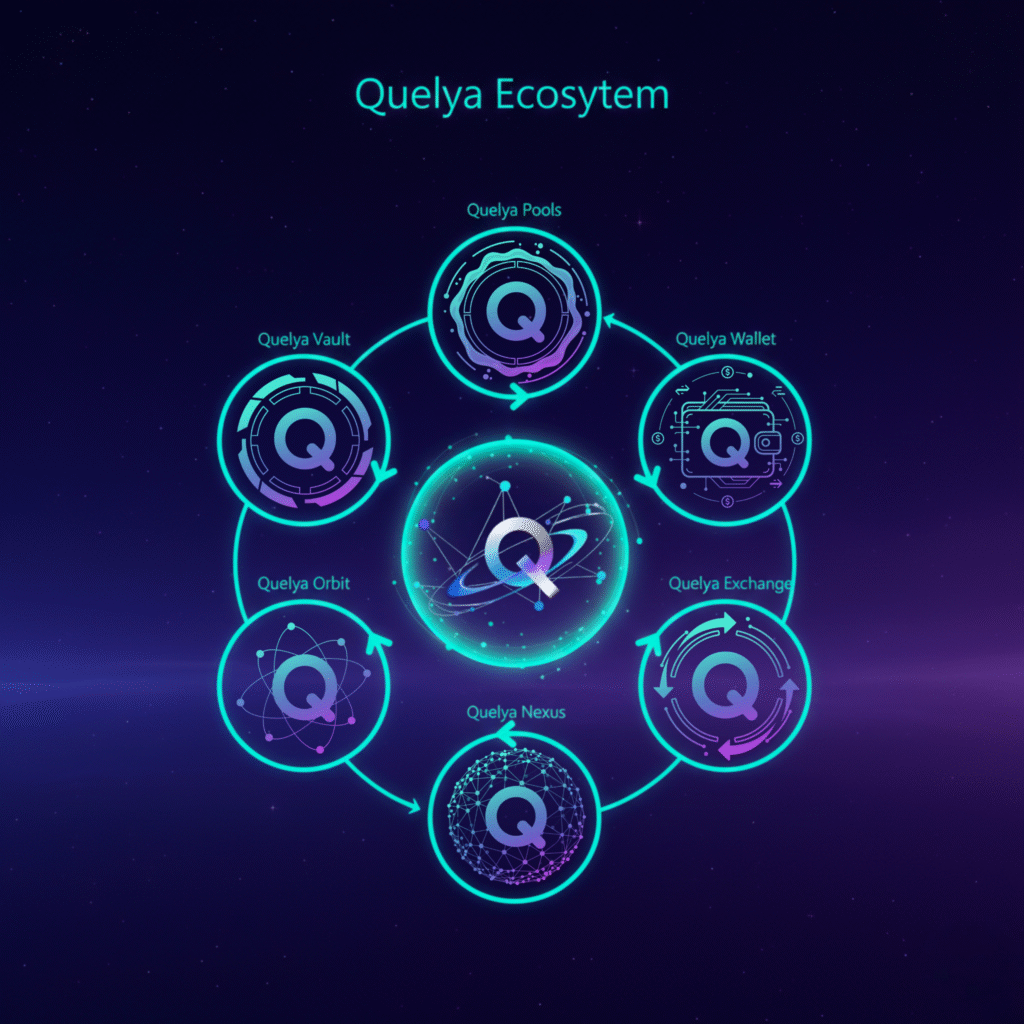

The Quelya Ecosystem operates as a self-sustaining network where every component interacts seamlessly — creating balance between liquidity growth, governance participation, and user empowerment. From the moment liquidity enters Quelya Pools to the governance decisions made in Quelya Orbit, every element plays a role in reinforcing stability, rewards, and expansion.

Flow Summary

Quelya Pools

The entry point for liquidity — users deposit assets and earn rewards.

Quelya Vault

Manages staking, yield strategies, and treasury distribution.

Quelya Orbit

DAO & governance layer overseeing proposals, votes, and protocol adjustments.

Quelya Nexus

Connects and optimizes system data — linking liquidity flows, rewards, and token metrics.

Quelya Wallet

Provides seamless asset management and governance access for users.

Quelya Exchange

Offers on-chain swaps and future cross-chain liquidity integration — expanding reach beyond Stellar.

Each layer communicates dynamically through the Quelya Core Protocol, ensuring that liquidity, utility, and governance move in a synchronized cycle — promoting sustainability and deflationary growth.

Future Vision & Development Roadmap

Building Beyond Boundaries.

Quelya is not a static protocol — it’s an evolving DeFi infrastructure.

Our long-term vision is to transform Quelya into a cross-chain liquidity hub, interlinking Stellar’s speed and scalability with other major ecosystems like Ethereum, Solana, and Polygon.

Each step in our development roadmap is designed to strengthen the foundation while expanding interoperability, governance, and user accessibility.

Key Milestones

Phase I – Establishment

Launch of Quelya Pools, Vault, and Tokenomics framework on Stellar.

Phase II – Expansion

Deployment of Quelya Orbit (DAO), Wallet, and Nexus — strengthening data flow and user participation.

Phase III – Exchange Launch

Launch of the native Quelya Exchange with deep liquidity integration and real-time on-chain analytics.

Phase IV – Cross-Chain Connectivity

Development of the Cross-Chain Liquidity Bridge and integration of non-Stellar assets into Quelya Pools.

Phase V – Full Decentralization

Transition to full governance autonomy, community proposals, and protocol-managed revenue allocation.

Phase VI – Global Integration & AI Liquidity Optimization

Expansion into multi-chain liquidity networks, incorporating AI-driven optimization for yield strategies, automated arbitrage balancing, and smart liquidity routing — making Quelya a self-evolving DeFi ecosystem.

Note: This section is purely meant as a visionary outlook.